Remain of Shahed 136 at an exhibition showing remains of missiles and drones that Russia used to attack Kyiv on May 12, 2023 in Kyiv, Ukraine. (Photo by Oleksii Samsonov /Global Images Ukraine via Getty Images)

BEIRUT — Israel and its allies may have managed to take out a vast majority of the 300-plus drones and missiles Iran launched in an unprecedented attack earlier this month, but analysts said the incident is unlikely to diminish the growing global appetite for Tehran’s unmanned systems.

“Most countries that are potentially interested in Iranian drones would not acquire them to use them against adversaries as capable as the US and Israel,” Fabian Hinz, a research fellow for Defence and Military Analysis at the International Institute for Strategic Studies, told Breaking Defense, echoing the view of other experts. “So the ability of extremely advanced adversaries, like the US and Israel, to intercept these might be less of a concern to them. The Iranian one-way attack UAVs [unmanned aerial vehicles], have proven themselves to work well.”

Likewise, Samuel Bendett, an artificial intelligence and unmanned systems expert at the Washington-based think tank CNA, said that the Israeli rebuff is “likely not to affect [Iran’s] sales, especially with countries seeking a more independent political and military policies from the West.”

RELATED: Iran says it shot down Israel’s attack. Here’s what air defense systems it might have used.

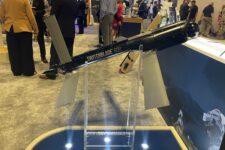

Late on April 13 Iran launched what an Israeli official later said were 170 drones, more than 30 cruise missiles and over 120 ballistic missiles at targets in Israel, a vast majority of which were intercepted before they could do much damage. Iranian state media reported two types of drones were involved in the attack: the delta-winged Shahed-131 and its larger brother, the Shahed-136.

Analysts estimate the 131 has a range between 700 and 1,000 kilometers, and the scaled-up 136 between 1,000 and 2,000 kilometers.

The Iranian news report noted the Shahed family of systems “have gained significant attention in recent years due to its use in operational scenarios,” almost certainly a reference to their purported extensive use by the Russian military against Ukraine. (Russia also reportedly uses Iranian Mohajer drones.)

In fact, it was the remains of a Shahed-131, dubbed Geran-1 by Russia, that Ukranian President Volodymyr Zelenskyy stood next to in a video in October 2022.

“The sound of ‘Shahed’ drones, a tool of terror, is the same in the skies over the Middle East and Europe,” Zelenskyy said in the hours after the Iranian attack on Israel.

RELATED: After shooting down Iranian munitions, Jordan defiant in uncomfortable spotlight

Jean Marc Rickli, the head of global and emerging risks at the Geneva Center for Security Policy, told Breaking Defense that “Ukraine is providing a powerful showcase for the Shahed” and said that even if the drones were defeated in the Israeli attack, they proved a significant “cost asymmetry.”

“Missiles to destroy these drones are much more expensive to use than the costs of these drones,” he said. “So, this contributes to imposing a more important cost on the defender while wearing down its capabilities. In the case of Israel, even though all Iranian drones were destroyed, their destruction had a cost that was likely higher than the one of using these drones.”

The calculation may look attractive to many international buyers.

Rickli said, “Iran’s potential market concerns countries that are subject to Western sanctions or do not fear Western sanctions or do not want to be bound by the conditions that Western countries impose when selling their weapons.”

It turns out that could refer to quite a few countries and organizations.

From Non-State To Nation-State Customers

Though the Shahed family has gained the most attention from the Ukraine conflict, it’s believed to have made its debut much closer to home years ago, in a Houthi attack on Saudi Arabia in 2019, according to the Royal United Services Institute.

The drones were disclosed publicly by the Israelis in 2021 and acknowledged by Iran later that year, RUSI said.

But since Russia’s use in Ukraine — which both Moscow and Tehran denied despite ample evidence compiled by Ukraine and the US Defense Intelligence Agency — global interest is said to have skyrocketed.

A few months after Russia’s invasion, a senior Iranian official reportedly said that 22 countries had shown interest in buying Iranian-made drones. Even that figure may be underselling it now, according to Israel’s defense minister, Yoav Gallant, who said in February that as many as 50 countries were “holding discussions” with Tehran about its missiles and drones.

RELATED: ‘Extremely concerned’: American generals raise alarm over Iran’s tightening ties with Russia, China

Data collected by the United States Institute of Peace showed that in addition to non-state proxies like Hezbollah and militias in Iraq and Syria, Iran has exported unmanned tech to at least seven countries from Tajikistan to Venezuela. Earlier this month Reuters reported Iranian drones may have made their way to the conflict in Sudan as well.

“Potential next targets may be Bolivia or Belarus, but we can also expect greater entrenchment of Iranian drones in places where they have already appeared, like sub-Saharan Africa and South America,” Behnam Ben Taleblu, senior fellow at The Foundation for Defense of Democracies, said. Currently, he said, Iranian drones “feature in conflict zones or jurisdictions across four continents: Asia, Africa, Europe, and South America.”

“That is already a robust [presence],” he said.

Bendett said he assumed that countries interested in procuring Iranian drones are states across “Africa and the Middle East that don’t have a problem with Iranian politics and don’t have a lot of money to buy expensive drones are potential candidates.”

Who Are Iran’s Competitors?

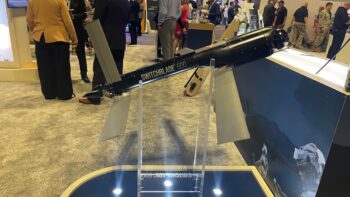

While the US, Israel and other Western nations may have a long history of bespoke, cutting edge UAVs, analysts said the Iranian drones offer a cheaper solution that also come with few political strings attached. China has dominated similar UAV exports, but beyond Beijing, experts said Iran has few competitors in its particular niche market.

“Iran is one of the few countries that has a combat-proven, well-working system in that category [of] longer range attack suicide drone …” Hinz said. “There’s not a lot [of that in the] market, there are a few other companies there are some Chinese companies now building very similar systems to the Shahed but short of the original system.”

It came as something of a surprise when reports first emerged the Iran was supplying drones to Russia, which is thought to have a more robust military industrial complex itself.

But, as Bendett said, “Iran did not replace Russian drones simply because there aren’t any Russian drones to speak of.

“Russia has advertised its drones for a while, but so far only Burma is flying Orlan-10 drones, outside of the former Soviet space, with customers like Kazakhstan and Armenia flying Russian UAVs,” he said. “And Russia only started to advertise its KUB loitering munition — the one that other countries may want, like Lancet drone, are not yet available for export.”

Hinz agreed that Iran’s drones won’t compete with Russian ones “because we haven’t really seen the Russian drones pop up in a lot of places.” He added that Russia has suicide drones and loitering munitions that are good but “whether [Russia] has any spare capacity to export them as they currently rebuild need in Ukraine. I have strong doubts perhaps there could be some technology transfer but apart from that, I don’t see them exporting large numbers.”

“The Iranians have proven that they’re capable of mass producing them in large numbers,” he said. “So I think these would be much more interesting [than other drones] for other countries.”

Ben Talelbu didn’t think that Iran’s drones will replace American, Israeli, Turkish or Russian unmanned aerial systems, “but they provide the arms market with lower-cost alternatives that allow purchasers to buy more.”

“And given that Iranian one-way attack drones can function as the poor man’s cruise missile, this is really where quantity can have a quality of its own,” he said. “To date, there isn’t good public data about larger purchases, as Iran has only recently moved from arms proliferator to arms salesman, but the big draw for Iranian drones is that they may come with less strings attached and less concern with interoperability for the client than others.”

TAI exec claims 20 Turkish KAAN fighters to be delivered in 2028

Temel Kotil, TAI’s general manager, claimed that the domestically-produced Turkish jet will outperform the F-35 Joint Strike Fighter.