The August 1st aerobatic demonstration team of the People’s Liberation Army Air Force (PLAAF) Chinese Air Force perform during an aerial display at the Langkawi International Maritime and Aerospace Exhibition 2023 (LIMA ’23) on May 23, 2023 in Langkawi, Malaysia. (Photo by Annice Lyn/Getty Images)

PADANG MATSIRAT LANGKAWI, Malaysia — Under the hot Malaysian sun of this year’s Langkawi International Maritime and Aerospace Exhibition (LIMA), the traditional defense suppliers for the ASEAN nations — the US and Russia — were still visible. But the 16th edition of the show, held May 22-27, had floor space dominated not by the biggest players but by Turkey and China, two increasingly active nations on the global arms market.

And yet, at the end of the day, neither country walked away with any major deals signed — a reminder that the region, although potentially a ripe market, remains relatively strapped for cash when it comes to buying high-end defense equipment.

The show, the largest edition so far, is positioning itself as the off-year complement to the Singapore air show. This gives the Pacific Rim a major aerospace expo with a significant level of international participation each year. Yet, nations in the region provide a challenge for the biggest global defense companies, as the needs and defense budgets tend to be more modest than what a major prime might offer.

At the 2023 show the number of square meters occupied by US firms was miniscule compared with that of past LIMA expos — mirroring the drop in the interest by Malaysia in procuring American-made hardware. But that was balanced out by a dramatic expansion in presences by Turkey and China, which had the largest and second-largest non-Malaysian industrial presences on the show floor.

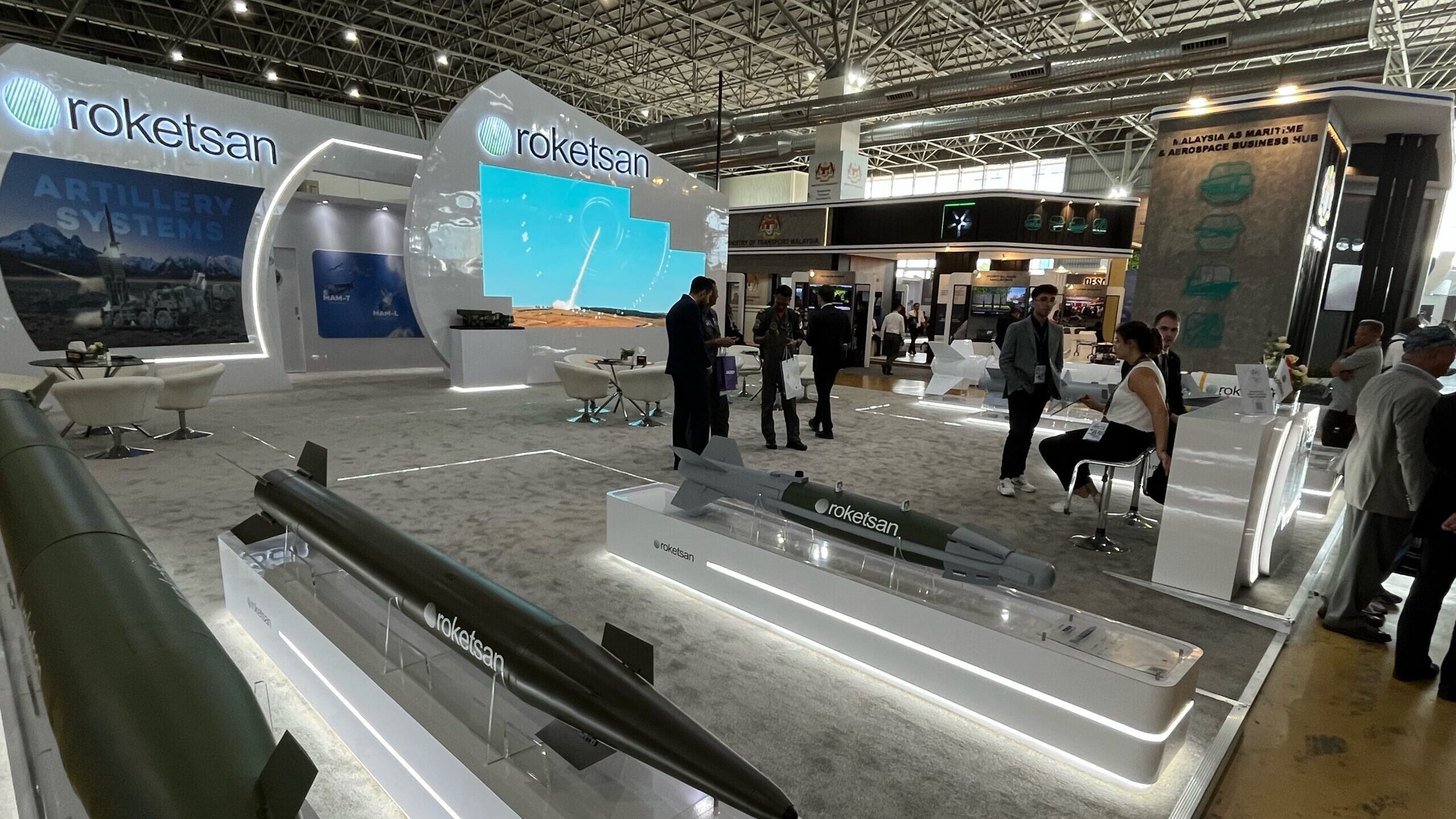

Turkey is hoping to take over the role of that the US has plated as a major supplier to Malaysia, Indonesia and other neighboring states. Eighteen Turkish firms, to include Aselsan, Roketsan, ASFAT, Havelsan, Meteksan Defence, STM, Turkish Aerospace Industries, and Turkey’s Defence Industry Agency occupied more space than that of any other nation.

The Roketsan booth at LIMA 2023. (Reuben Johnson for Breaking Defense)

Despite the presence, the only notable sale announced was the acquisition of three Turkish Aerospace Industries (TAI) Anka 2 unmanned air vehicles (UAVs) as part of Malaysia’s Medium Altitude Long Endurance (MALE) Phase 1 requirement. That comes with a MYR 424 million ($92 million) price tag, hardly earth shaking by defense market standards. Still, numerous agreements of cooperation were signed during LIMA– ranging from aerospace systems to homeland security projects, a sign Turkey expects to be a player in the market for the long-term.

Running a close second to Turkey’s presence at LIMA were a constellation of PRC firms, including large exhibits from four of the major state-owned defense firms – China Electronics Technology, Ltd (CETC); China Precision Machinery Import-Export Corporation (CPMIEC), China North Industries Corporation (NORINCO) and China State Shipbuilding Corporation (CSSC).

The ambition of these firms is “to replace the Russian portion of the market that exists in Malaysia and elsewhere,” said one China defense analyst who is based in the region.

Some of these Chinese companies were also not anxious to reveal the details of their origins. At least one Chinese firm in attendance was doing so under a name of a company created in late November 2022, even though they were displaying wares from a well-known Chinese entity. And while there was no indication on advertising materials that it is PRC-based, the company’s representatives revealed during the show that manufacturing operations are based both in the Special Economic Zone of Shenzhen with a second site near Shanghai.

None of the larger Chinese firms would state any particular country or procurement in the region as being a primary target or motivation for such a high-profile presence at LIMA. The large PRC delegation, said more than one representative, was “just to show our capabilities and to try and attract potential customers.”

When pressed, some of the same Chinese firms stated that they saw little near-term opportunities in the region despite an anemic US presence because “countries in this part of the world usually buy only American weapons anyway.”

When it was pointed out that the largest procurement as of late was of South Korean weapons – namely the 18 KAI FA-50 combat aircraft – one Chinese representative replied, “oh Korean weapons or American weapons. It’s the same thing so no difference.”

The CETC booth at LIMA 2023. (Reuben Johnson for Breaking Defense)

European firms at LIMA told Breaking Defense that they also felt the need to “show our flag” at this expo. But the representative of one company stated that his country’s ambassador had said “there literally is almost no money [for defence acquisition] in Malaysia at present” and that any business development would be a long-term process.

The same ambassador related that there are almost no major projects “that can seriously be pursued that do not involve Petronas,” the Malaysia state-owned energy company. “They are the only entity that can support the necessary financing.”

That may provide an opportunity for PRC firms, said one former senior US military intelligence officer contacted by Breaking Defense. Nations that have no deep pockets “often fall for the ‘debt trap’ option that Beijing is famous for offering,” he said.

“Malaysia would seem ripe for the picking – Beijing handing over weapons or support for the Russian weapons that the RMAF operate and all on credit. This would give the PRC leverage with them later,” he continued. “It is a possibility that Washington should be doing its best to prevent.”

Actual Versus Potential Sales

In terms of actual sales, the US still showed up on the ledger, selling four US Sikorksy UH-60A+ Blackhawk helicopters. These helos, however, are regarded only as a gap-filler to replace Malaysia’s aging Sikorsky S-61A4 (designation Nuri) models, which have been grounded since 2020-2021 due to obsolescence.

These aircraft will also not be purchased directly by the Malaysian Armed Forces, but instead leased from Aerotree Defence & Services Sdn Bhd. They will become a platform for the Malaysian Army’s Aviation Wing (Pasukan Udara Tentera Darat or PUTD) for training and operational flight requirements, according to a statement from the Malaysian Defence Ministry. The service already operates two other earlier models of the Blackhawk for VIP and liaison functions.

In addition, a contract with Italy’s Leonardo was signed for two ATR-72MP Maritime Patrol Aircraft (MPA) to be operated by the RMAF. These platforms will be “Phase 1” of a larger MPA acquisition program with a contract value at MYR 790 million ($171.6 million).

And in the largest new acquisition, the RMAF will purchase 18 FA-50 Block 20 Fighter-Lead-In-Trainer/Light Combat Aircraft (FLIT-LCA) from Korea Aerospace Industries, Ltd. (KAI). These aircraft will replace the 12 BAE Systems Hawk 208 models acquired in the early 1990s.

Russia wasn’t absent from the show, dispatching a 40-50 person delegation to LIMA that were officially accompanying the Russian Knights demonstration team. Their actual role, sources with knowledge of the Russian delegation told Breaking Defense, was quietly trying to reassure the RMAF that they would be able to continue supporting the weapon systems they have delivered in the past.

The RMAF became one of the first non-traditional buyers of Russian-made hardware when it purchased the Mikoyan MiG-29N in the mid-1990s. These aircraft have since been retired but in the early 2000s the force acquired 18 Su-30MKM variants that are still in operation.

The problem faced by the RMAF is the sanctions regime applied to Russia’s defense industrial sector following Moscow’s February 2022 invasion of Ukraine complicates the long-term supply of spares. Since entering Malaysian service these aircraft have been maintained by a Sukhoi-Airod (a major Malaysian MRO) joint venture, Aerospace Technology Systems Corporation (ATSC). The Malaysian half of the partnership hold a 70 percent share in the operation.

The company’s tech personnel and RMAF engineers stated just after last year’s invasion that the joint venture had roughly two years of spare parts stockpiled. If there are further maintenance issues, they stated more than a year ago, other operators of similar models of the aircraft, such as India or China, could provide the necessary assistance.

Nonetheless, RMAF officials at LIMA expressed some concern about the eventual unsustainability of this aircraft type, echoing long-standing concerns about the engines in particular.