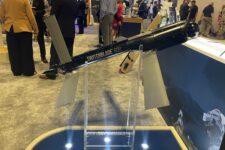

Patria’s 6×6 vehicle being delivered for Latvia and Finland. (Patria)

AUCKLAND: While Russia flexes its muscles at Ukraine, the other nations on Vladimir Putin’s border are watching nervously — and, in some cases, moving quickly to try and shore up their military capabilities.

The Baltic nations of Estonia, Lithuania and Latvia are well aware that they represent NATO’s eastern flank. The situation between Ukraine and the trio are different, of course; the security guarantee of the alliance is something Kyiv lacks. But the leadership of the former Soviet states talk openly about the need to be vigilant against Russian attack, and all three nations are currently investing in modernizing their military capabilities as a result.

The problem is that even with a focus on modernization, the defense budgets of all three nations are relatively small — approximately €2.87 billion in 2022 ($3.22 billion, or 0.4% of the Pentagon’s fiscal 2022 budget request). As a result, the modernization efforts have to be focused, with the land forces receiving the majority of the funding, according to Tony Lawrence, a research fellow at the International Centre for Defence and Security (ICDS) in Tallinn.

RELATED: Across Europe, Billions Being Funneled Into New Armored Vehicle Programs

The self-defense doctrines of Estonia, Latvia and Lithuania require well-equipped and well-trained land forces that “should be able to inflict enough pain to make an adversary think twice” about invading and “hold off or blunt an attack until NATO reinforcements arrive,” Lawrence told Breaking Defense.

Estonia’s 2022 defense budget of €748 million ($865 million), announced last September, is the largest the country has ever allocated to defense, representing about 2.31% of GDP. This follows an earlier spending boost in the 2021 budget that increased it from 2.11% to 2.29% of GDP.

For Latvia, defense spending for 2022 has been slated at €758.35 million representing 2.3% of GDP. This is an increase over the €707.82 million allocated for 2021. In the wake of the Ukrainian crisis, ministers last week made the case that Latvian defense spending should increase to 2.5% of GDP over the next three years.

In Lithuania, the Ministry for National Defence (MND) announced in October that its defense budget for 2022 would be €1.176 billion ($1.367 billion) representing an increase in share of GDP from 2.03% to 2.05% with plans to reach 2.5% by 2030.

“Overall these modernization efforts seem to be heading in the right direction. The ambition is quite narrow and uncomplicated — to build small, but capable territorial defense armies — and the Baltic states clearly focus their defense modernization and development efforts towards this,” Lawrence said.

Ground Vehicle Focus

All three nations are investing heavily in ground vehicles at the moment.

The Estonian MoD has allocated €25 million for 4×4 and 6×6 wheeled vehicles and another €15 million for an additional six K9 Thunder self-propelled howitzers to increase its fleet to 24, with deliveries are expected in 2023. It is also completing an upgrade of 37 CV9030N Mk I Infantry Fighting Vehicles (IFVs) using local defense company Milrem for €36 million.

A spokesperson from the Estonian MoD told Breaking Defense that a market survey for 6×6 armored vehicles has been completed with a second market survey for 4×4 armored vehicles still ongoing. “Procurement of both vehicle types is scheduled to begin early in third quarter of 2022,” the Estonian MoD spokesperson added.

One option could be joining the Common Armoured Vehicle System (CAVS) project run by Finland and Latvia that is providing a new 6×6 vehicle based on a platform from Finnish company Patria.

The IFV modernization project is still in the prototyping phase. The Estonian MoD spokesperson confirmed that the first prototypes will be handed over by the end of 2022, with final deliveries scheduled for the first quarter of 2024. The intent is to install 120mm mortars from Israeli company Elbit onto the CV90 chassis, with negotiations underway for a contract award expected by the end of the first quarter 2022.

RELATED: Finland, Latvia To Jointly Procure 360 Land Vehicles; Estonia, Sweden Could Join

Latvia is currently accepting delivery of 198 ex-British Army Combat Reconnaissance Vehicles – Tracked (CVR(T)), under two separate deals signed in 2014 and 2019. A spokesperson from the Latvian MoD told Breaking Defense that it has received all 124 from the first order and 46 of 74 from the second order. Of these 170 units handed over so far, the spokesperson confirmed 116 are “fully renewed” — which is to say, in top-shape despite being pre-owned.

The armored CVR(T) will replace existing transport vehicles and there are plans to equip the platforms with Spike Anti-Tank Guided Missiles starting in 2023.

In October 2021, Patria announced it had delivered its first CAVS 6×6 armored personnel carriers (APC) to Latvia. Latvia has ordered up to 200 APCs to improve the mobility of its ground forces, in order to replace the aging XA-series Pasi APC. The Latvian MoD spokesperson said that following a delivery of 10 CAVS in 2021, there would be approximately 37 delivered in 2022, with future deliveries depending on the impact of COVID-19 on supply chains.

The Vilkas IFV variant of the Boxer APC in Lithuanian will replace the existing M113 APCs and provide increased lethality. (Lithuanian MoD)

In 2019 the Latvian MoD released a tender for a €200 million project for a new 4×4 tactical vehicles; while a requirement still remains, the Latvian spokesperson said that this effort is “temporarily suspended.”

In Lithuania, the main land equipment programs include the acquisition of the Vilkas Infantry Fighting Vehicle variant of the Boxer APC, NASAMS air defense system and Joint Light Tactical Vehicle (JLTVs).

The MND ordered 88 Vilkas vehicles from the German ARTEC industrial consortium in 2016, in a $450 million contract to equip two Iron Wolf Mechanised Infantry Brigades. Unspecified technical issues have caused a delay in delivery, but one brigade has been outfitted already and the final batch of vehicles is due to arrive later in 2022.

In 2021 the MND took delivery of an initial batch of 50 JLTV heavy gun carrier variants, under a Foreign Military Sales agreement with the US. Total orders are for 200 under a €150 million contract with Oshkosh Defense, with the remaining vehicles will be delivered at a rate of 50 year through to 2024. The JLTVs be used by the Iron Wolf brigades, Griffon Mechanised Infantry Brigades and Lithuanian Special Forces replacing the existing fleet of HMMWVs.

“The main focus of the three armies in recent years has been the programs to mechanize (part of) their infantries – Estonia through the CV90 acquisition, Latvia with CVR(T), and Lithuania with Boxer,” Lawrence said, “These programs will contribute to the Baltic states’ ability to frustrate an attack by enemy armor — a task that they had previously had to rely on motorized infantry to accomplish.”

“But they have left little room for other land systems procurement programs — not only because of cost, but also because introducing an entirely new capability takes up a great deal of bandwidth in a small army,” he warned.

Other Equipment Needed

Other recent additions to the Baltic states defense forces include the Spike-SR anti-tank weapon, which Estonia is buying to supplement the LR2 variant that is already in service. The Estonian Centre for Defence Investment announced on Jan. 20 that it had signed a €40 million contract with the EuroSpike consortium for an undisclosed number of the missiles that will begin deliveries this year. These will replace the 90mm towed anti-tank guns currently in-service as well as the Milan anti-tank missile.

Estonia has also ordered 120mm mortars from Elbit in a contract worth €15 million. It is not clear if this will be the company’s Spear or Cardom system, but it is expected these will be fitted to Estonia’s new 4×4 vehicle.

The Baltic states have also invested in the Carl Gustav M4 84mm anti-tank weapon, built by Swedish defense manufacturer Saab Systems. Estonia received its first batch of 300 M4s in December, under a €1.3 million ($1.43 million) joint order with Latvia. The Latvian MoD spokesperson said that all the M4s it had ordered with Estonia in 2020 have been delivered.

The NASAMS III system provides a much needed medium range air defence capability to the Lithuanian Armed Forces. (Lithuania MND)

Meanwhile on Jan. 11, the Lithuania ordered the M4 in a $16.8 million deal with Saab; the country already operates the M2 and M3 designs.

The Lithuanian Army is also taking delivery of about 3,000 new MeoForce DF 1-4×22 riflescopes from Czech company Meopta Systems. These will be completed this year, and will be fitted to the new G36 assault rifles that are being delivered from Heckler & Koch in 2022-23 under a €19 million contract signed in September. Lithuania is also increasing its inventory of FGM-148F Javelin ATGMs with an FMS order for 230 missiles and 20 Command Launch Units.

“I would also add [that] Lithuania’s procurement of NASAMS medium-range air defence systems, goes some way to addressing a key capability shortfall — Russia would be expected to use air power heavily if it attacked the Baltic states. Estonia and Latvia hope to follow Lithuania’s lead once resources permit,” Lawrence said.

The Lithuanian Armed Forces took delivery of the NASAMS III system in October 2020. Norwegian company Kongsberg provided two batteries under a $128 million contract signed in October 2017.

The Baltic states inherited little in terms of former Soviet military equipment after securing independence in 1991, so the countries have had to build up armed forces from scratch. Lawrence said that they have come a long way in the past 30 years but they still need to develop capabilities that exist in more mature armies – “not so much modernization, as creation.”

So what could come next? There are clear shortfalls in terms of ground-based air defense — partially filled by NASAMS — long-range fires and early warning. The Baltic states also need to invest in basic items like body armor, night vision equipment, small arms and rebuilding ammunition stocks.

With the Ukraine situation serving as a blinding warning sign on the risks of being a Russian neighbor, the defense ministries and their supporters may have a golden opportunity to push for more defense funding in the near future. How they spend it will set the tone for their homeland defense strategies over the next decade.